WHAT ARE THE TAX FORMS & THEIR DUE DATES?

1. Payment form (Individuals/Corporations/Partnerships):

0605 On or before the last day of January every year after the initial registration.

2. Income Tax - for Individuals

1701Q 1Q Jan-Mar Apr 15

1701Q 2Q Apr-Jun Aug 15

1701Q 3Q Jul-Sep Nov 15

1701 final Jan-Dec Apr 15 FF Yr

3. Income Tax - Corporations or Partnerships

1702Q 60 days end of quarter

1702 Calendar-Apr 15 FF Yr

Fiscal 15th day of the 4th month ff the end of the taxable year.

4. Value Added Tax (VAT)

2550M 20th day of succeeding month

2550Q 25th day of the month following the end of a particular quarter (together with the Summary List of Sales & Purchases where total sales exceed Php2.5M or total purchases exceed Php1M)

5. Percentage Tax

2551M 20th day after the end of each month

For affordable Accounting & Bookkeeping Services just PM me or Call/Txt 0999-4504922

Results 1 to 10 of 156

Thread: TAX info and updates

-

08-05-2008, 11:54 AM #1Junior Member

- Join Date

- Sep 2005

- Posts

- 251

TAX info and updates

TAX info and updates

-

08-13-2008, 06:30 AM #2Banned User

- Join Date

- Apr 2008

- Gender

- Posts

- 1,743

i highly recommend your accounting services... reasonable price and quick in service...

-

08-15-2008, 06:16 AM #3

pila man imong charge sa accounting and book keeping brad?

-

08-16-2008, 07:00 PM #4Junior Member

- Join Date

- Sep 2005

- Posts

- 251

isang, i sent you PM kay out of topic ta.

I'll redirect you with this link nalang for other inquiries...

https://www.istorya.net/forums/specia...nterprise.html

-

09-30-2008, 05:08 PM #5Junior Member

- Join Date

- Sep 2005

- Posts

- 251

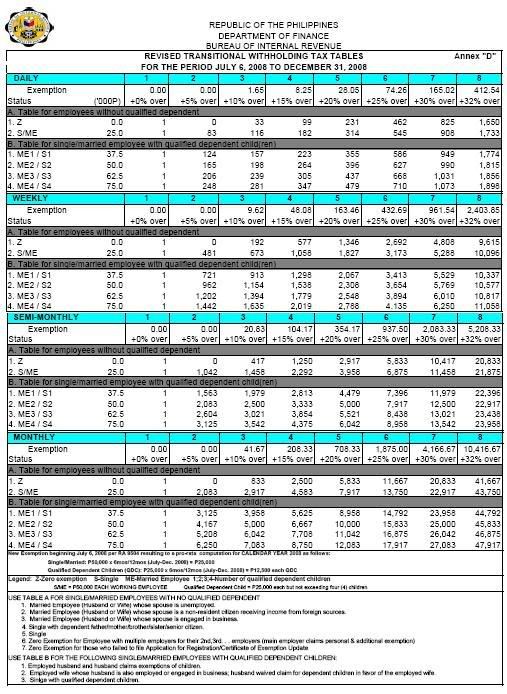

Revenue Regulation No. 10-2008 implements certain provisions of RA No. 9504 - Tax Exemptions for Minimum Wage Earners and Increased Tax Exemptions. Read full text ftp://ftp.bir.gov.ph/webadmin1/pdf/4...%2010-2008.pdf

revised withholding tax table... ftp://ftp.bir.gov.ph/webadmin1/pdf/42126AnnexC.pdf

revised transitional withholding tax table... ftp://ftp.bir.gov.ph/webadmin1/pdf/42126Annex%20D.pdf

__________________________________________________ ________________________

For affordable Accounting & Bookkeeping Services, just PM me or txt 0999-4504922

-

10-03-2008, 01:18 AM #6Junior Member

- Join Date

- Sep 2005

- Posts

- 251

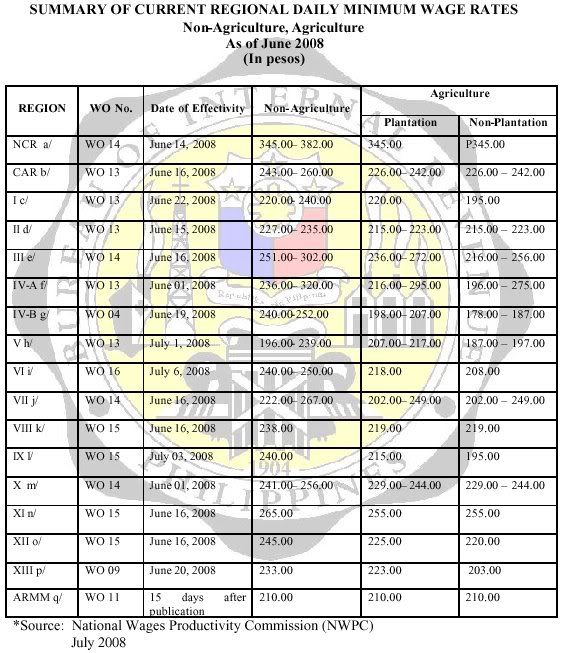

Minimum Wage Rate...

Tan-awa kung asa ka nga Region na-belong...

--------------------------------------------------------------------------------

For affordable Accounting & Bookkeeping Services, just PM me or txt 0999-4504922

---------------------------------------------------------------------------------

-

10-13-2008, 01:03 PM #7Junior Member

- Join Date

- Sep 2005

- Posts

- 251

DID YOU KNOW THAT...

Beginning May 10, 2008 employees receiving the following benefits from their employers shall enjoy higher tax exemption thresholds:

- Rice allowance from the P1,000 per month was increased to P1,500 per month

- Uniform and clothing allowance from P3,000 per year was increased to P4,000 per year.

These allowances are classified as DE MINIMIS benefits and are exempt from the tax on compensation when given to rank and file employees and from the fringe benefits tax (FBT) when given to managerial and supervisory employees.

Another good thing about this, is that on the side of the employer, this can be claimed as expenses of the business.

__________________________________________________ _________________________________

For affordable accounting & bookkeeping services, call or txt 0999-4504922 look for jalyn / donde

__________________________________________________ _________________________________

...

-

10-13-2008, 07:06 PM #8Junior Member

- Join Date

- Sep 2005

- Posts

- 251

GUIDELINES ON THE USE OF CORPORATE AND PARTNERSHIP NAMES

( SEC Memorandum Circular No. 5, July 17, 2008 )

The Securities and Exchange Commission (SEC) has issued a set of guidelines and procedures in the registration of corporate names that takes effect beginning August 9, 2008. Among the guidelines issued are:

1. Mandatory inclusion in the name:

___a. For corporations - the word "Corporation" or "Incorporated" or their abbreviation;

___b. For partnerships - the word " Company" or "Limited" or their abbreviation. Professional partnerships may bear the name "Company", "Associates", "Partners", or similar names;

___c. For a foundation - the word "Foundation"

2. The term describing the business should refer to its primary purpose.

3. Only one business or trade name shall be registered for each corporate or partnership name.

4. For the protection of the public and other justifiable causes, the SEC shall, in general, disallow the use of names that are misleading, deceptive, confusingly similar to a registered name, or contrary to morals, good customs and public policies.

5. The name of a dissolved or revoked corporation cannot be used by another company within three (3) years from approval of the dissolution or six (6) years from revocation unless authorized by the majority shareholders at the time of dissolution or revocation.

6. The reservation of a name cannot be deemed an approval for the use of the name. The company, upon registration, should submit an undertaking to change its name when the SEC finds that such name is not consistent with the guidelines.

-

10-13-2008, 07:18 PM #9

nindot ni dah.. very informative.. hehe

-

10-14-2008, 11:18 PM #10

Very Good Sir. 100 point for you.

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote