Hi all istoryan entrepreneurs,

Planned to do a pharmacy and general merchandise business (franchise), done with the DTI business name, Mayor's Permit and now i'm already working with the BIR and SSS. I have several questions jud so that before i go to these establishments kay diritso na ang flow unta hopefully. That's why i need your help guys, like pretty please!

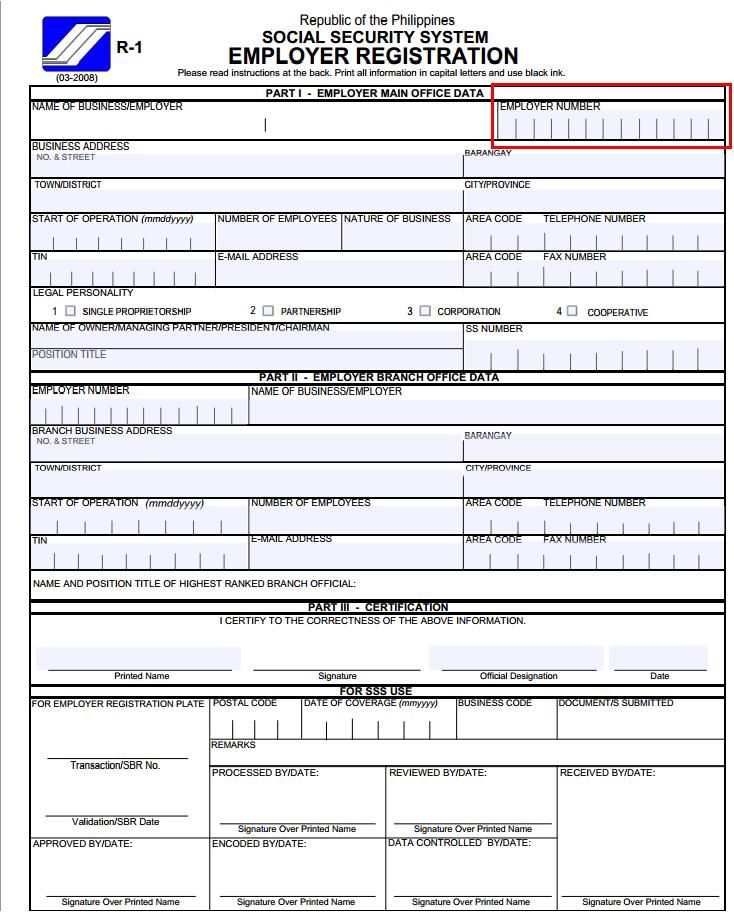

SSS R-1 Form

1. Kanang 13 digit employer number, i have sss number before katong employed pa ko in my previous work. Mao ba japun ang number gamiton? Or hatagan rako nila ug lahi napud na number?

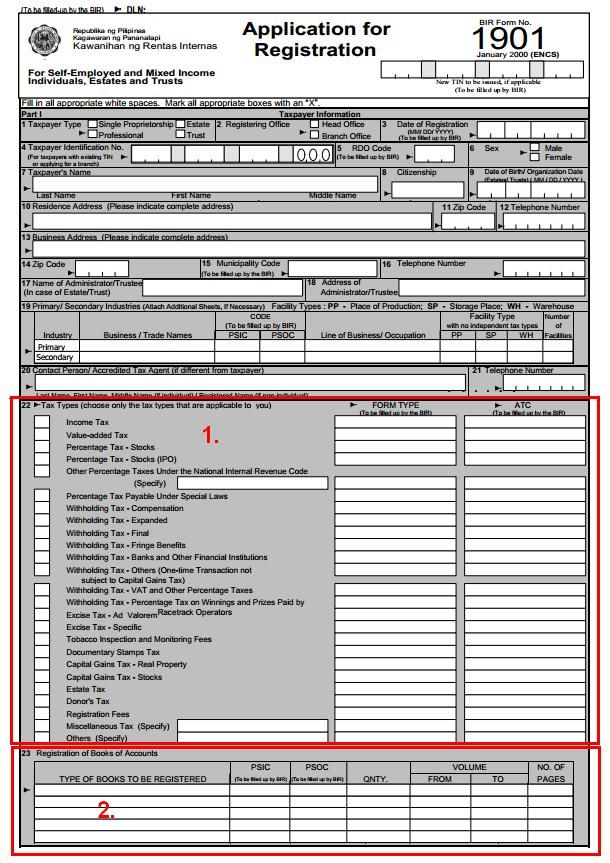

BIR 1901 Form

Questions 1 and 2. Wa ko kahibaw jud unsa ni.

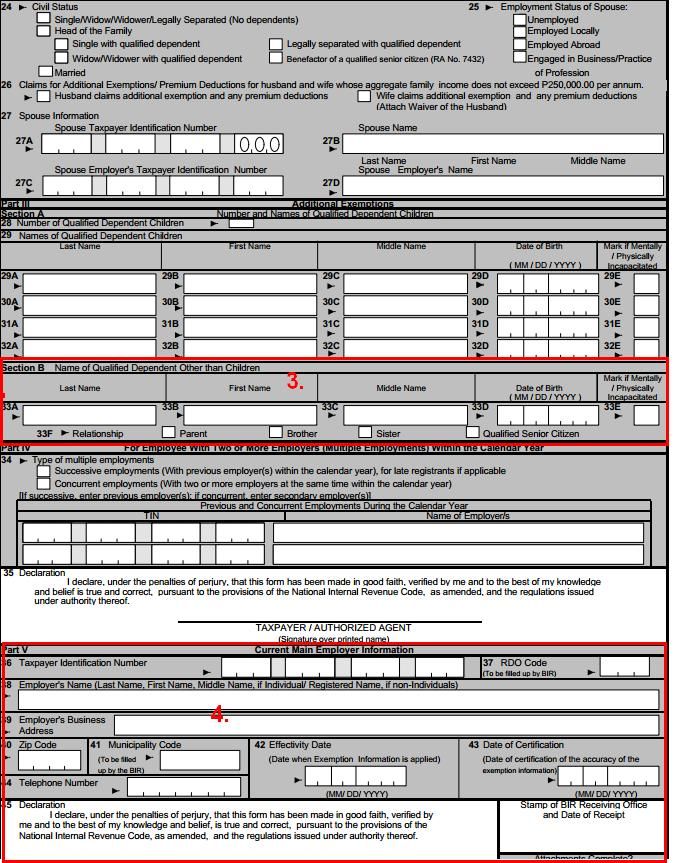

3. Ok raba father nako ang dependent?

4. Wala sad ko kahibaw unsay ibutang..

Hope naay mureply unta before tomorrow, coz muadto nako ugma. And i really appreciate to those istoryans na mureply.

THANK YOU VERY MUCH! GOD BLESS!

Results 1 to 10 of 28

-

02-19-2013, 08:50 AM #1

Ask for help in BIR 1901 and SSS R-1 forms. (Registration of New Business)

Ask for help in BIR 1901 and SSS R-1 forms. (Registration of New Business)

-

02-19-2013, 09:02 AM #2Elite Member

- Join Date

- Dec 2010

- Gender

- Posts

- 1,087

1. Ask ka new number as Employer. Different man na employer number and employee number.

2. About ani, TS. Mas mao ask lang ka kaila na accountant or bookkeeper kay sueto cla ani.

3. Puede ra imong father ang dependent.

4. Ask sad ka BIR new TIN as an employer. Like sa SSS, TS. Different na BIR TIN as employer and BIR TIN as employee.

-

02-19-2013, 09:13 AM #3Newbie

- Join Date

- Mar 2011

- Gender

- Posts

- 32

Ur TIN is lifetime. I.update lng na imu records from employee into business na. If u have multiple TINs, u will be penalized. Just leave no. 1 blank, taga office lng ang mgfill.up ana. No. 2 are the books u will register like ledger, sales book, cash disbursement, etc. The only dependent considered is/are ur children only. Dli pwd ikarga ang mama og papa. No. 4, just leave it blank. Asa man imu address mam? Pwd sad ko mag.bookkeep if u like.

-

02-19-2013, 09:33 AM #4

Okay now galibog ko kay lahi2x mo ug answer.. hehe. But thanks for replying, atleast i have an idea. Now back to my questions.

For the SSS.

On SSS form, i'll just leaved it blanked. Since lahi man kaha ang employer number compared to my E-1 number.

For the BIR.

1. Answered

2. So i better leave it blank again or i'll just input these things: 1) ledger, (2) columnar books, and (1) linear journal?

3. Diri ko naglibog

4. Answered

Follow up kay galibog pud ko, pls clarify. Different answers. Thanks!

-

02-19-2013, 09:54 AM #5Elite Member

- Join Date

- Dec 2010

- Gender

- Posts

- 1,087

@TS, sa ako nakit-san dri sa amo we have different number as an Employer and Employee. Mao na ako lang sad e share nimo sa ako na kit-an dri. Ako man gud mo adto sa mga transaction sa SSS and BIR kay para walay paltos ang mga bay-ranan so walay penalty.

About naa change to business number wala sad ko kahibalo na. Pag himo namo amo business nag kuha ko new number for Employer's TIN and my Employee's TIN is gigamit ra kay I'm working under the new company we establish.

About ana dependent, para nako if kong wala paka na minyo, and walay work imong papa og mama, maybe puede na cla considered imong dependent.

Para sure lang TS ask lang didto sa SSS og BIR.

goodluck sa imo business venture.

-

02-19-2013, 09:58 AM #6

1. SSS Employer number

- If your previous SSS number is for employed or voluntary, lahi sad na ang employer number. you will have two different SSS numbers, 1 for personal use and the other is under your Business name.

2. BIR

a. That is the taxes and fees your gonna pay. taga BIR na mo fill-up ana.

Daghan mn kayo na uy, hihi...

bitaw mao ni ang general lang ha dayon ask nlng sa BIR sa uban:

Withholding TAX:

Compensation- for your employees. Let them have register sad and secure TIN numbers. Monthly basis ni siya

Compensation Final- tax gihapon sa employees pero annually na ni.

Expanded- Rentals

Income TAX:

Percentage TAX

- monthly, quarterly and annually ni siya.

Registration Fees/ Renewal of Registration

- annually

- not sure if P500 gihapon

b. book of accounts

- palit ka anang columnar, journal, etc...

- dapat ipatatak nii siya sa BIR

- taga BIR na mo advise nimo unsa imo kuhaon depende what type imong business.

- you can make your own format ani, di sila mo provide. tasagaran Bookkeeper kahibaw ani pero you can do it yourself

- naa dira ang credit and debit sa imo business operation

- journal-- naa diri imong sales nga mura scratch lang sa, hehe... pero dapat hapsay gihapon

- a portion of the columnar should coincide with what is written sa imo journal

c. Dependents other than Children

- pwede parents beyond 60 y.o.

- pwede those dependents with disabilities, kana di capable to earn a living dayon ikaw nag-support

d. Employer information

- since 1901 mn imo gikuha it means you are employed at the same time earning from business or other sources of income.

- Employer information-- basically info sa imo employer ra na.

If 1902 imo gikuha,

pure business ra na siya.

P.S.: You will only have one TIN. mao rana imo gamiton whether employed or self-employed.

For SSS, lahi ang personal and sa business.

naa ka emloyees? kuwang pana imo forms.

by the way, need pa sad ka moadto sa Pag-ibig, lahi ang personal and as employer.

-

02-19-2013, 10:52 AM #7

My mother wala syay work, housewife but age is 48. Makaqualify bah?

Sahay man gud, kaning wa tay kaila sa SSS ug BIR maglisod tag pangutana, labi na mga busyhan jd ning kasagaran tao ngadto, that's why try ko ask diri sa istorya, maybe anyone could help. And thanks for replying on my thread.

Very informative, highly appreciated for the information about this. I would like to ask if there will be seminars about this after makaregister ko sa BIR. Murag need jud ang one on one na explaination.

Murag diri ko nahagba dah, and i thank you for the information. I am actually researching for the requirements in establishing a pharmacy, then almost all na gi-feature sa internet kay Form 1901. So that's why i printed the 1901 pud. I'll check the 1902.

Is it ok na dili nako muapply ug PAGIBIG? Dili nuon sya required sa LTO (License to operate). Or need ni sya sah for the employees?

Actually, wala pako employees, pero naa nakoy murag reserved employees pohon. Gisaaran na nako sila. I'm still waiting for the documents to finish jud, BFAD takes time in processing. They say it takes 1-2 months daw in process.

-

02-19-2013, 11:16 AM #8

Follow up question:

Kaning sa SSS, kung cebu ako previous branch, dapat ba na mubalhin pud ko sa laen branch kung asa located ako business? I'm doin' business in liloan, so same ba ni sya sa BIR na magtransfer ug RDO?

-

02-19-2013, 11:45 AM #9Elite Member

- Join Date

- Dec 2010

- Gender

- Posts

- 1,087

SSS, PAG-IBIG, and PHILHEALTH morag required man cguro ni para sa imong mga employee, TS. Mas nindot man sad naa ni cla ani kay magamit gyud na nila and nimo in case kong na-ay ma hospital or accident, salary loan, and ig retire nila. Kuha-e lang cla gyud ana , TS. kay daghan na kaayo sa news na gikiha sa ila employee ang employer kay wala cla ani na benefit total deductible raman sad ni sa ila salary.

Kana SSS, TS. Dili lang ko sure kong mobalhin ba gyud ka. Sa ako na situation didto ko sa lapu-lapu branch bisan naa ko sa Mandaue. Pero I think puede cguro bisag asa kay naka suyaw ko sa-una ni ask ko information sa Cebu branch naka hatag man cla info unya ako record naa sa lapu-lapu.

-

02-19-2013, 12:11 PM #10

Thanks sir Mojo info sa SSS. Packing up things for SSS now na. Ready na sya. BIR nalang kuwang.

Kaning sa PHILHEALTH ug PAG-IBIG, murag unya na ni nako asikasohon kanang nagtukod na ako business. Ang BFAD ako problem gud as of the moment, dugay lagi process.

Thanks for the quick response sir!

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote