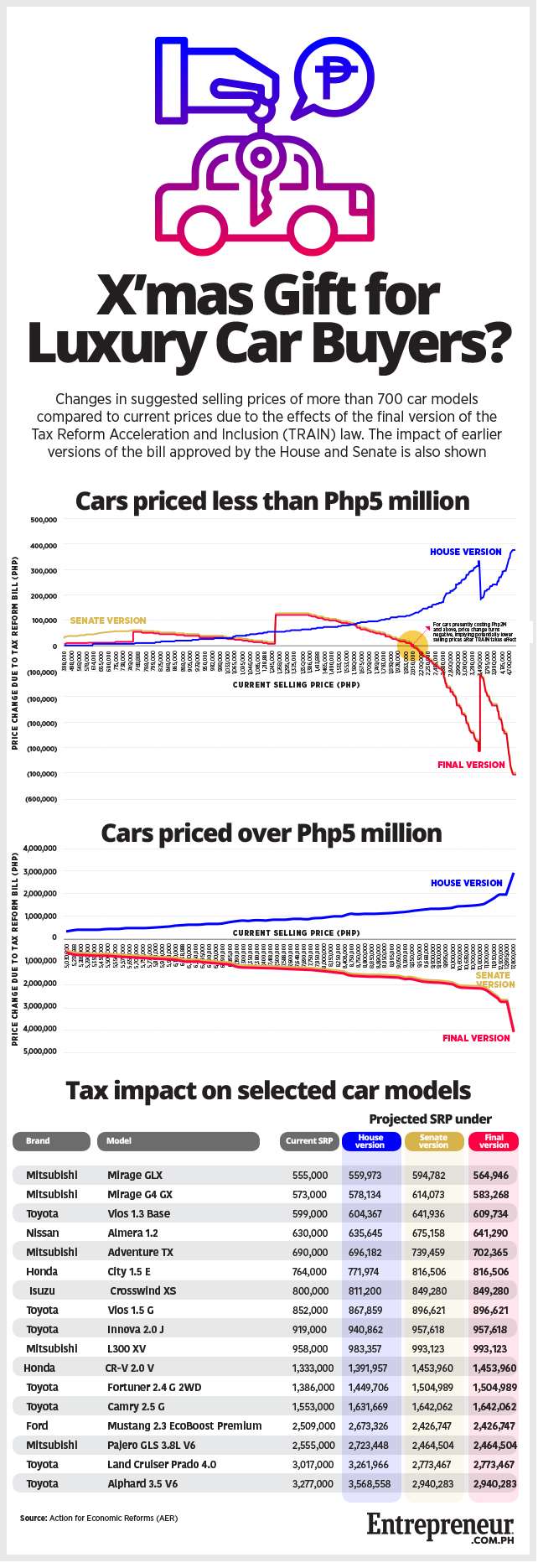

Hybrid vehicles shall be subject to 50% of the applicable excise tax rates. But purely electric vehicles and pick-ups shall be exempt from excise tax. and based on the new computation, some of the cars are now cheaper.

Price increase

Wigo - P11k

Vios - P26k

Altis - P131k

Innova - P128k more

Fortuner - P128k more

Price Decrease

Hilux - less P55k to P145k (for the high end model)

Prius - less P217k

LandCruiser - less P272k to 350k

Prado - less P202k

---------

for GASOLINE

P2017 - P1000 for 20liters of gas

P2018 - P1060 for 20liters of gas

gamay ra kaayu ang difference vs sa imong take home pay.

-----

Take note - imong take home pay - between P2000 to P7000

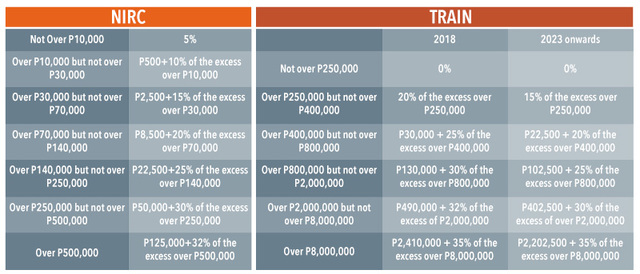

All employees earning P8million or less gets lesser tax.

Actually, if your monthly income is less than P883750, you dont pay any additional taxes.

P800k monthly still gets P2500 take home pay.

Results 121 to 130 of 162

Thread: New Tax System

-

01-08-2018, 03:45 PM #121

-

01-09-2018, 03:38 PM #122

-

01-09-2018, 04:28 PM #123Banned User

- Join Date

- May 2016

- Posts

- 336

-

01-09-2018, 10:21 PM #124

dli na mo matter if naay dependent same ra tax sa wala?

-

01-09-2018, 10:39 PM #125

-

01-12-2018, 10:28 AM #126

i mean if mupalit ka ug gas sa 2017 - at P46 pesos per litter

20liters will cost you = 20xP46 = P920

in 2018, if mu increase na siya (ithink +P2.50), the new rate is P48.50

20liters will cost you = 20xP48.50 = P970

-- P50 pesos ra ang increase sa imong budget. i spend P1000 per week sa gas, P200 ang increase sa ako take home budget.

- - - Updated - - -

in 2023, mas gamay na ang ang tax, less 5% pa gyud sa existing 2018 tax. except nag belong ka sa P8million salaray

-

01-12-2018, 05:53 PM #127

Car tax - 2018

Notes on Ford Mustang, Pajero, LandCruiser, Alphard - Prices decreases but i think for some companies, instead of decreasing the price, they will use this to increase their profits instead of dropping prices. who knows.

-

01-15-2018, 06:21 PM #128

Naka experience na ko ani pag palit nakog coke sa tindahan... animal oy, mahala na jud. P35 na isa ka litro. Hahaha. tubig is life.

Next nako gi huwat ako sweldo. Awn nako wa bay kaltas sa tax... animal sad oy ,wa pa jud ni sud sa atm da..

-

01-15-2018, 06:42 PM #129

daghan jud mo hilak ani once magsugod na og increase ang plete og price sa basic como.

-

01-16-2018, 02:34 PM #130

Similar Threads |

|

Reply With Quote

Reply With Quote

dili.. dili ko kakamao ana..

dili.. dili ko kakamao ana..