mga bay, unsa mn ang mga butang na tax deductible or ma write-off nato? Ug pwede ra ka mag file annually ang tax kay murag labad mn kkau kng kwarterly especially kng small business.

salamat.

Results 101 to 110 of 156

Thread: TAX info and updates

-

07-14-2011, 06:24 PM #101Senior Member

- Join Date

- Mar 2008

- Gender

- Posts

- 865

Re: TAX info and updates

Re: TAX info and updates

-

09-08-2011, 04:50 PM #102Junior Member

- Join Date

- Sep 2005

- Posts

- 251

Re: TAX info and updates

Re: TAX info and updates

mao siguro ni imong pasabot... allowable expenses nga pwede ma claim as deduction?

71 Salaries and Allowances

72 Fringe Benefit

73 SSS, GSIS, Medicare, HDMF and Other Contribution

74 Commission

75 Outside Services

76 Advertising

77 Rental

78 Insurance

79 Royalties

80 Repairs and Maintenance

81 Representation and Entertainment

82 Transportation and Travel

83 Fuel and Oil

84 Communication, Light and Water

85 Supplies

86 Interest

87 Taxes and Licenses

88 Losses

89 Bad Debts

90 Depreciation

91 Amortization of Intangibles

92 Depletion

93 Charitable Contribution

94 Research and Development

95 Amortization of Pension Trust Contribution

96 Miscellaneous

... in addition, ang COST OF SALES/SERVICES, apil sad na nimo ug deduct...

I hope nga natubag nako imong pangutana.

-

10-22-2011, 01:55 PM #103Junior Member

- Join Date

- Sep 2005

- Posts

- 251

Re: TAX info and updates

Re: TAX info and updates

TOWN MAYOR'S HUBBY FACES TAX RAPS

THE Bureau of Internal Revenue (BIR) filed tax evasion charges yesterday against businessman Nilo Alegado, husband of Consolacion Municipal Mayor Teresa Alegado.

The BIR said that Alegado failed to provide the correct information in his internal tax return or ITR for 2009, declaring only P4.33-million worth of sales while he actually earned P183.94 million.

“[The] total percentage of under-declaration of sales per investigation is 4,143.34 percent,” the BIR said in its statement.

Mayor Alegado denied allegations that her husband Nilo failed to pay the correct income tax for 2009....

read full story... Town mayor

-

10-23-2011, 07:06 PM #104Newbie

- Join Date

- Oct 2011

- Gender

- Posts

- 3

Re: TAX info and updates

Re: TAX info and updates

where can i secure legal forms that i can use?

-

10-23-2011, 07:14 PM #105Newbie

- Join Date

- Oct 2011

- Gender

- Posts

- 1

Re: TAX info and updates

Re: TAX info and updates

there are lots of website offering FREE PHILIPPINE LEGAL FORMS, but you can try visiting a website i always visit if i want to know some PHILIPPINE LAWS, CEBU LAWYERS, and FREE PHILIPPINE LEGAL FORMS... visit www.PHILCORPORATION.com

-

10-23-2011, 07:16 PM #106Newbie

- Join Date

- Oct 2011

- Gender

- Posts

- 3

Re: TAX info and updates

Re: TAX info and updates

thanks... www.philcorporation.com is very useful. its entirely free Philippine Form.

thanks man.

-

10-24-2011, 12:07 PM #107Junior Member

- Join Date

- Sep 2005

- Posts

- 251

Re: TAX info and updates

Re: TAX info and updates

Value-Added Tax (VAT)

-is a form of sales tax. It is a tax on consumption levied on the sale, barter, exchange or lease of goods or properties and services in the Philippines and on importation of goods into the Philippines. It is an indirect tax, which may be shifted or passed on to the buyer, transferee or lessee of goods, properties or services.

Who Are Required To File VAT Returns

=>Any person or entity who, in the course of his trade or business, sells, barters, exchanges, leases goods or properties and renders services subject to VAT, if the aggregate amount of actual gross sales or receipts exceed One Million Five Hundred Thousand Pesos (P1,500,000.00).

=>A person required to register as VAT taxpayer but failed to register

=>Any person, whether or not made in the course of his trade or business, who imports goods

-

10-28-2011, 01:22 PM #108Junior Member

- Join Date

- Sep 2005

- Posts

- 251

Re: TAX info and updates

Re: TAX info and updates

Monthly VAT Declarations

Tax Form

BIR Form 2550 M - Monthly Value-Added Tax Declaration (February 2007 ENCS)

Documentary Requirements:

1. Duly issued Certificate of Creditable VAT Withheld at Source (BIR Form No. 2307), if applicable

2. Summary Alphalist of Withholding Agents of Income Payments Subjected to Withholding Tax At Source (SAWT), if applicable

3. Duly approved Tax Debit Memo, if applicable

4. Duly approved Tax Credit Certificate, if applicable

5. Authorization letter, if return is filed by authorized representative.

-

10-28-2011, 01:39 PM #109

Re: TAX info and updates

Re: TAX info and updates

VAT na tawn among negosyo ron dako sa 12 percent uy.. kinsai maka explain diri nga naa mi transaction pero non vat pa mi ato nya ang presyo pang non vat pero na vat mig kalit nya ang presyo dili na namo ma addan ug 12% kay di na mo sugot ang buyer 6000 pcs ang order nya kansi nami sa 12% kay VAT naman mi. dako pud kaayo ang 90k nga kuha sa VAT sa 6000pcs. kinsa maka enlighten nako ani..

-

10-30-2011, 01:14 AM #110Junior Member

- Join Date

- Sep 2005

- Posts

- 251

Re: TAX info and updates

Re: TAX info and updates

Yes, dako jud ang rate nga 12%, but you need not worry kay you can claim man pud input vat of 12% from your purchases, and besides VAT is an indirect tax, you may pass that to your customers.

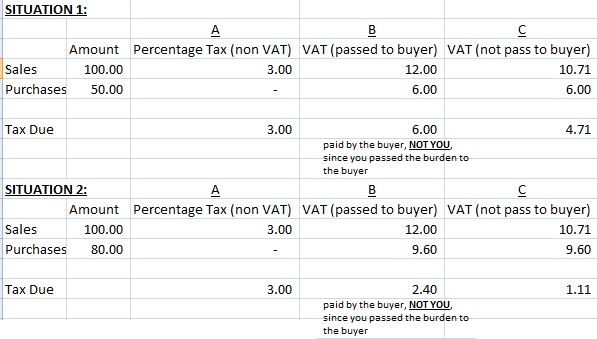

I hope this illustration would help:

In Situation 1, if your purchases covers 50% of your sales, though you are paying higher tax being a VAT registered, but the difference is not that much (exclude column B when making a comparison, since it is not you who pay the tax but rather the customer)

In Situation 2, considering your purchases covers 80% of your sales, it turns out that you are paying lesser tax if you are VAT registered compare to Non-VAT. If i will relate this to your case, i think ang imong gi-reklamo is ang VAT sa imong Sales, remember dili ang VAT sa imong sales ang imong ibayad sa BIR but rather ang tax due (refer sa illustration). When you are a VAT registered, you have the benefit of deducting the input VAT from your output VAT.

In situation 2, dapat malipay ka nga VAT registered naka kay mas gamay raka bayaran nga tax.

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote