Pls Delete If I post this thread in the wrong section.

Nid lng nako og advice if natural raba nga sobra ang tax nga gikaltas nimo.. Diba for salary ranging 10,000 - 30,000 ang tax kay 500 plus 10% over sa 10,000... For Example, if my salary rate is 15,000 my tax would be 500 plus 10% OF 5,000 which is equal to 1,000 pesos per month.. But the case is 1,000 per 15 days na hinoon imbis per month.. Any idea kung pde bata maka reklamo ani or mao gyud ni cya? And also kung nag start ka og february sa company, tinood ba nga mabalik daw tanan nimo nabayad as tax by the end of the year as a tax refund.. tnx sa mga mo reply..

Results 1 to 9 of 9

Thread: Tax Issues

-

03-16-2012, 05:02 PM #1

Tax Issues

Tax Issues

-

03-16-2012, 05:29 PM #2C.I.A.

- Join Date

- Jun 2005

- Posts

- 2,816

Re: Tax Issues

Re: Tax Issues

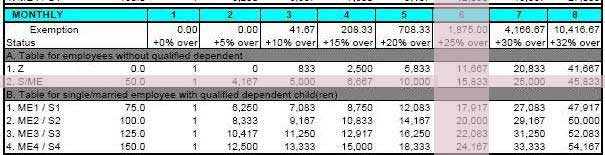

Kani may basehan pag compute sa tax bro.

ftp://ftp.bir.gov.ph/webadmin1/pdf/1601_c_tax_rates.pdf

And also, ma refund na ang imo excess sa tax computation every year bro.

-

03-16-2012, 05:34 PM #3C.I.A.

- Join Date

- Jun 2005

- Posts

- 2,816

Re: Tax Issues

Re: Tax Issues

Base sa table, if nagsweldo kag 15,000 then Single (Table A column 4 is applied). ang imo monthly tax computation is:

= 708.33 + 0.20*(15,000 - 10000)

= 708.33 + 1000

= 1708.33. Mao nani imo monthly tax deduction sa imo 15,000 na sweldo. Wala pana deducti sa imo SSS, PhilHealth, ug Pag-ibig.Last edited by xyberblue; 03-16-2012 at 06:39 PM.

-

03-16-2012, 09:30 PM #4

-

03-17-2012, 08:11 AM #5C.I.A.

- Join Date

- Jun 2005

- Posts

- 2,816

Re: Tax Issues

Re: Tax Issues

Diko sure ana bro pero murag dili mana tinuod. Ang excess nuon sa yearly computation maoy ma refund sa imoha.

Like for example, every month gi kaltasan sa tax base sa computation above then it happens na naay sayup sa mga computation nila sa imo tax. Then inig compute nila sa imo yearly tax, mas gamay imo annual tax computation compare sa imo na deduct na. I refund na nila ang difference sa imo annual computation ug sa ilang na deduct na. Then possible sad na ikaw pay ma minusan in case dako ang annual compare sa ila na deduct na nimo.

Nindot unta if tinuod jd na ma refund tanan bro. dako jd ang ma refund nimo ana.

-

03-17-2012, 01:53 PM #6

Re: Tax Issues

Re: Tax Issues

correct me if i'm wrong ha.

you will be computed with 0-exempt if naa kay previous employer within year, di ko ka-tell if dako kag refund or gamay, depende na sa previous employer nimo if silay ga-assume. but if wala kay employer, mo follow ang new company nimo sa table to compute your tax. dili pud assurance dako or gamay ang refund by the end of the year. naa ra na sa mga kamot sa CPA unsaon na niya pagduwa-duwa ang numero.

if moresign tag company makadawat man tag tax refund ana diba, ato buhaton unta ana is to remit it to BIR. pero kadaghan or kaha tanan nato kinsa pa man ganahan moremit. mao na sa next employer mahibong ka dagko kaayog kaltas, because you paid off the tax refund you received from the previous employer. mahuman ra kag bayad by the end of the year, and balik sa normal tax range nimo igka next new year.

-

03-17-2012, 11:22 PM #7

Re: Tax Issues

Re: Tax Issues

Sakto xyberblue na computation... Depende sad sa imuhang status... Subaya lang diri na table bro..

Last edited by balipseyev; 03-17-2012 at 11:25 PM.

-

03-17-2012, 11:27 PM #8

-

03-18-2012, 01:32 AM #9

Re: Tax Issues

Re: Tax Issues

Consult a CPA or Taxn expert for you to be guided regarding your issue.

Advertisement

Similar Threads |

|

Reply With Quote

Reply With Quote